Table Of Content

The key ingredient to home price trends is how much buyers are actually willing and able to pay for a home in the current market, weighing all the economic factors that go along with making that calculation. Use the Ownerly home value estimation data to see approximately how much a home is worth based on the local area.For home sellers, use the property value estimator to find optimal market price trends in your neighborhood. A home’s value depends on thingslike physical condition, upgrades and location, and seeing an estimate before getting an appraisal can help you understand the true value ahead of time. If you are in the market to sell, an experienced local real estate agent or professional appraiser can often provide the most accurate value.

The most accurate online home estimate

Mortgage lenders require an appraisal before they will approve your loan. Factors like the home’s layout, its structural condition, any improvements made such as renovations or extensions and the overall housing market condition can significantly influence its value. Also, the location, access to amenities, ratings of local schools and demand in your area play massive roles when it comes to determining your home’s worth. Use the Ownerly online portal to try and help you estimate your home’s value.

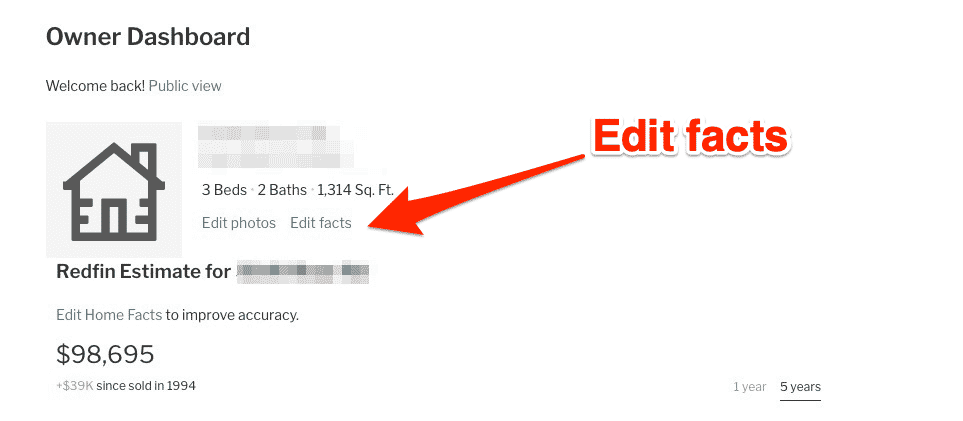

About the Redfin Estimate

You can compare valuations to a seller’s listing price or keep an eye on a specific neighborhood that you wish to move to in the future. One factor often quoted when thinking about how a home’s value goes up (or down) is the fundamental concept of supply and demand. In short, when there are more buyers than available homes, buyers will find themselves competing amongst one another, bringing home prices up. The size and usable space of your home and property, along with the age and condition, will also weigh heavily into its calculated market value.

Refinance

In addition to a home value estimator, some sites may provide additional tools for the user. For example, some sites allow users to search for or list a home for sale. Some may also offer a glossary of mortgage terms, educational resources, and credit cards. Depending on which home value estimator a user chooses, there could be various other products that the site wants the user to consider.

Average home value increase per year could affect your choices and financial security. Here's what's the home appreciation rate and ways to keep it as high as possible. Selling your home as is could be easy, but you also might make less money. If you bought a home on the outskirts of town and now in 2023, there’s a gourmet grocery store and a variety of upscale retailers nearby, your value has likely gone up.

Area & Neighborhood

Like other estimates, the Redfin Estimate is not a formal appraisal or substitute for the in-person expertise of a real estate agent or professional appraiser. If you’re thinking about selling your home, or just want to talk more about what it’s worth, we encourage you to contact a Redfin real estate agent at any time. Speaking with a Redfin Agent is free of charge, and there is no obligation to list your home for sale or work with Redfin. Pennymac’s online estimator is powered by a best-in-class Real Estate Automated Valuation Model (AVM).

Why Home Value Estimate Tools Aren't as Accurate as You Think - Real Estate

Why Home Value Estimate Tools Aren't as Accurate as You Think.

Posted: Thu, 11 Feb 2016 08:00:00 GMT [source]

Make a mortgage payment, get info on your escrow, submit an insurance claim, request a payoff quote or sign in to your account. All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Search an address to access comprehensive records and verify ownership history.

Find the right homeowner tools to plan and care for your home and property. We refresh Zestimates for all homes daily, but on rare occasions this schedule is interrupted by algorithmic changes or new analytical features. However, we never allow future information to influence a historical Zestimate (for example, a sale in 2019 could not influence a 2018 Zestimate valuation).

She writes stories for BobVila.com on various topics ranging from chimney cleaning to property management companies. In addition, she has been a freelance writer for 2 years, writing on a variety of topics including history, entrepreneurs, entertainment, the medical industry, and of course, home improvement. The Home Value Estimator provides you with valuable market information to help you weigh your potential options for a home purchase, sale or refinance. Pennymac’s Home Value Estimator will take the address of a property and weigh multiple factors in order to give you a reliable estimate. This, ultimately, is the amount a buyer would be willing to pay for the home. Fair market value is heavily dependent on the state of your local housing market, in addition to the factors listed above.

Sellers, buyers, and refinancers should all be familiar with appraisals and how they fit in the homebuying/selling or mortgage process. Once the appraisal process is completed, there are a couple of scenarios that buyers and sellers can expect. Checking a home valuation tool periodically can be helpful even if you’re not thinking of selling.

Depending on its algorithms, a home value estimator site may update daily, weekly, monthly, or at other intervals. Some of the most common reasons a homeowner would use a home value estimator site is when selling or buying a home, considering a loan, or refinancing. Home value estimators can return results for homes on or off the market.

For example, a Zestimate may be $260,503, while the Estimated Sale Range is $226,638 to $307,394. A wider range generally indicates a more uncertain Zestimate, which might be the result of unique home factors or less data available for the region or that particular home. It’s important to consider the size of the Estimated Sale Range because it offers important context about the Zestimate’s anticipated accuracy. The Zestimate is designed to be a neutral estimate of the fair market value of a home, based on publicly available and user-submitted data.

How Much Is My House Worth? – Forbes Advisor - Mortgages - Forbes

How Much Is My House Worth? – Forbes Advisor - Mortgages.

Posted: Wed, 25 Aug 2021 07:00:00 GMT [source]

Other factors include the sale prices of the homes around you (called comparables) and whether you’re in a good school district. “Your home should appreciate in value at the rate that the general economy is appreciating at,” Ailion said. Find out how much your house may be worth with our home value estimator with fresh 2023 real estate data points.

We’ll walk you through the loan qualification requirements, various first-time homebuyer programs, and loan options available. Believe it or not, there is a right time, and knowing when that is can get your home sold faster and at a higher asking price. There are three main types of home valuation, and all might assign slightly different dollar amounts to the same house. For example, the same home may have an assessed value of $300K, an appraised value of $395K and a fair market value of $400K. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit.

No comments:

Post a Comment